Why We Won't See a Housing Market Crash: Key Differences from 2008

Concerns about a potential housing market crash often bring back memories of the 2008 financial crisis. However, the current market conditions are fundamentally different from those that led to the crash. Here's why we won't see a repeat of 2008, focusing on the significant undersupply of homes.

1. Existing Homes: A Scarcity of Listings

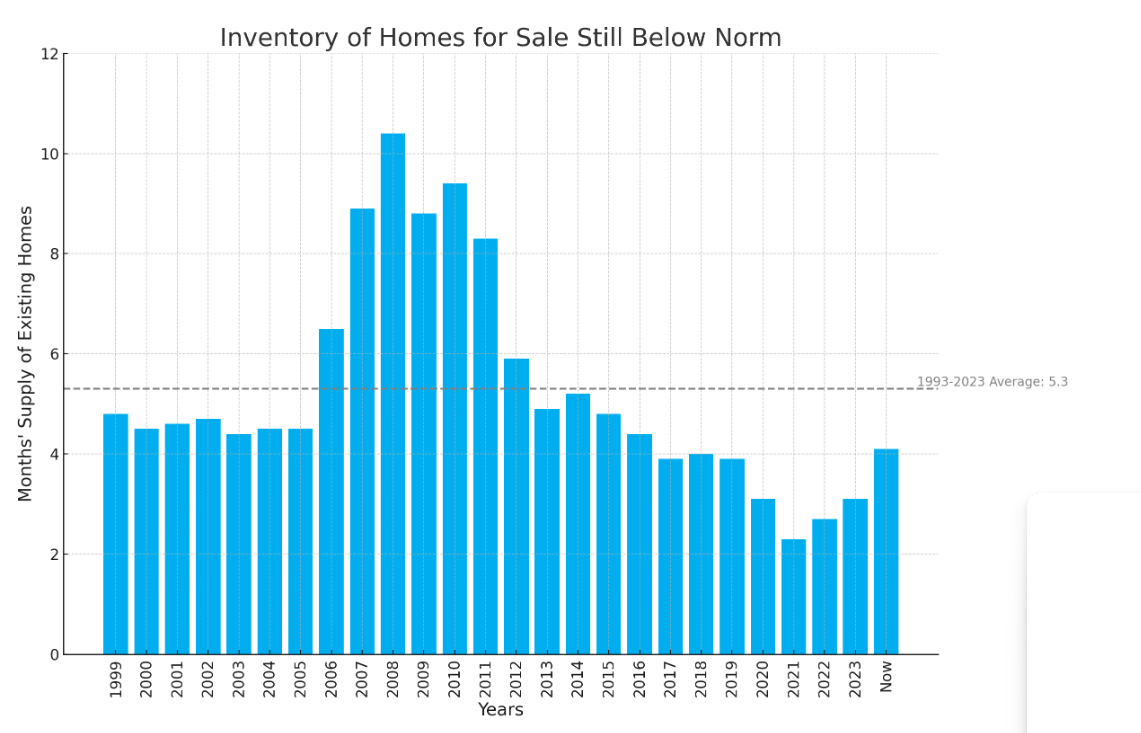

One of the most striking differences between now and 2008 is the number of existing homes available for sale. Back then, there was a glut of homes on the market, leading to plummeting prices and widespread foreclosures. Today, the situation is quite the opposite. The inventory of existing homes is at historically low levels. Homeowners are staying put longer, and many are hesitant to sell, contributing to the tight supply. This scarcity helps maintain home prices and prevents the kind of rapid depreciation seen during the last crash.

2. New Homes: Slow Pace of Construction

The construction of new homes also paints a different picture than in 2008. During the run-up to the previous crash, builders were producing homes at an unsustainable rate, leading to an oversupply. Now, despite high demand, the pace of new home construction has been slow. Builders face various challenges, including supply chain disruptions, labor shortages, and rising costs of materials. These factors limit the number of new homes entering the market, contributing to the overall undersupply and supporting home prices.

3. Foreclosures: Significantly Reduced Levels

Foreclosures played a central role in the housing market collapse of 2008. At that time, risky lending practices led to a surge in defaults and foreclosures, flooding the market with distressed properties. Today, the situation is much different. Stricter lending standards and higher homeowner equity have resulted in a much lower foreclosure rate. Additionally, many homeowners have taken advantage of historically low-interest rates to refinance and reduce their monthly payments, further reducing the risk of default.

Conclusion

The housing market today is characterized by a significant undersupply of homes, unlike the oversupply that precipitated the crash in 2008. The scarcity of existing homes, the slow pace of new home construction, and the low levels of foreclosures all contribute to a stable market. While no market is entirely immune to fluctuations, the current conditions suggest that a housing market crash like the one experienced in 2008 is highly unlikely. Buyers and sellers can take comfort in the fact that today's market dynamics are fundamentally stronger and more resilient.

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "