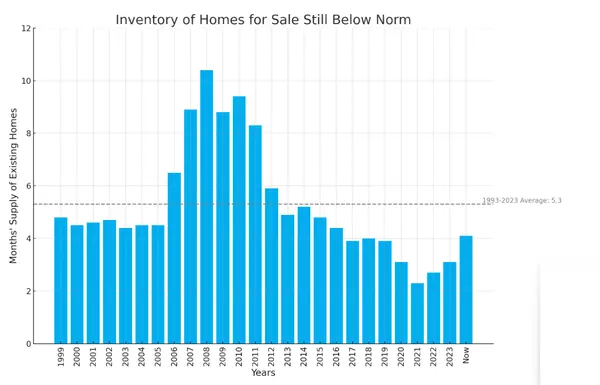

Why We Won't See a Housing Market Crash: Key Differences from 2008

Concerns about a potential housing market crash often bring back memories of the 2008 financial crisis. However, the current market conditions are fundamentally different from those that led to the crash. Here's why we won't see a repeat of 2008, focusing on the significant undersupply of homes. 1

Read More

Financial Fundamentals for First-Time Homebuyers

Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus on as you set out to buy a home.Build Your CreditYour credit is one element that

Read More

What Makes a House a Home?

There’s no denying the long-term financial benefits of owning a home, but today’s housing market may have you wondering if now’s still the time to buy. While the financial aspects of buying a home are important, the non-financial and emotional reasons are too.Home means something different to all of

Read More

What To Expect From the Housing Market in 2023

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position.As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that’s ne

Read More

Recent Posts